The Tea Tariff imposed by the British Parliament in 1773, often associated with the Tea Act, effectively adjusted the existing duty on tea rather than introducing a new tax. When adjusted for inflation, the financial impact translates to roughly $1.7 million in today’s currency, based on damages reported during the Boston Tea Party where 90,000 pounds of tea worth £9,569 were destroyed.

The Tea Act of 1773 authorized the East India Company (EIC) to export tea directly to American colonies without paying certain customs duties. This reduced costs for the EIC but kept the existing Townshend tax on tea, set at 3 pence per pound in 1767. The Act did not add a new tariff; it offered a drawback, allowing the EIC to sell tea at reduced prices compared to smugglers. This was intended to undercut illegal trade but also ensured tax revenue continued flowing to Britain.

The Boston Tea Party, a direct protest against the Tea Act and the principle of taxation without representation, destroyed 342 crates of tea weighing approximately 260 pounds each. The EIC’s reported financial loss of £9,569 converts to about $1,700,000 today when adjusted for inflation. Each pound of tea carried roughly a 3 pence tax, which amounted to a 20-25% tax rate and retail prices around 4 shillings per pound.

Merchants such as John Hancock and Samuel Adams, both involved in smuggling and distributing untaxed Dutch tea, were most affected by the Act’s market manipulations. The EIC’s direct sales model cut out traditional smugglers and wholesalers, intensifying colonial resentment.

The core issue lay less in the amount of the tax and more in the lack of colonial representation and the manipulation of the market by monopolistic practices. Colonists opposed paying taxes imposed by a Parliament in which they had no voice.

- The Tea Act reduced tariffs for the East India Company but kept the 3d Townshend tax.

- Damage from the Boston Tea Party was about £9,569, roughly $1.7 million today.

- The tax added 20-25% to the wholesale tea price, with retail prices near 4 shillings per pound.

- Market control and lack of political representation motivated colonial resistance more than tax size.

Tea Tariff (1773) Adjusted for Inflation: A Bitter Brew of Taxes, Smuggling, and Rebellion

The Tea Tariff of 1773 doesn’t mean what most people think. It’s not a new tax slapped on tea, but rather, a reduction in the cost of existing tariffs for the East India Company (EIC). This small tweak brewed big trouble, sparking a tea-fueled rebellion that shaped history. Let’s steep into the facts and discover what that tariff really meant, adjusted for inflation, and why it mattered.

The Tea Act of 1773: Not a New Tax, but a Clever Reduction

Firstly, the commonly held belief that the Tea Act created a new tax is a myth. Instead, it allowed the EIC to evade certain customs duties. Specifically, it let the company export tea duty-free to the American colonies. Why? To help the struggling EIC offload their surplus tea stock. The law stated:

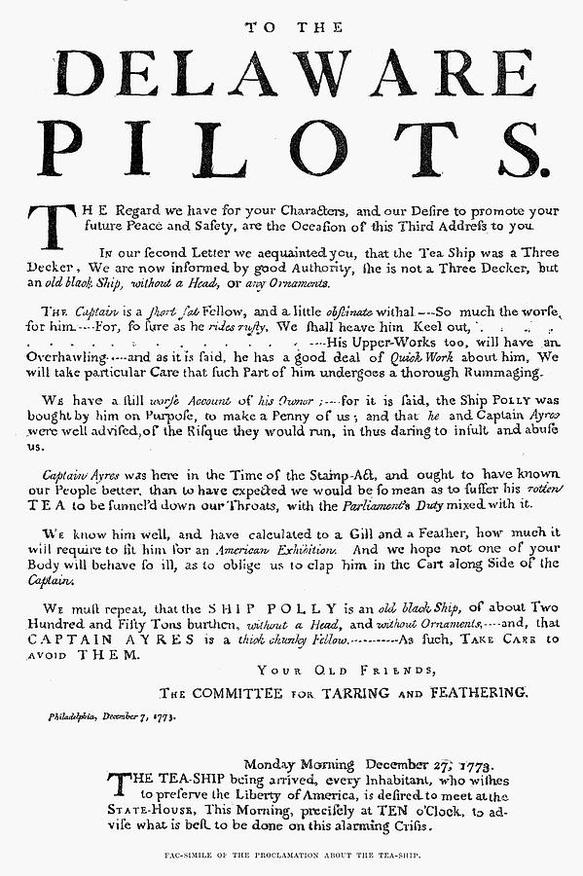

An act to allow a drawback of the duties of customs on the exportation of tea to any of His Majesty’s colonies in America; to increase the deposit on bohea tea; and to empower treasury commissioners to grant licenses to the East India Company to export tea duty-free.

By cutting costs for the EIC, tea prices could drop. Sounds fair, right? But here’s the catch: this wasn’t just about price—it was about control.

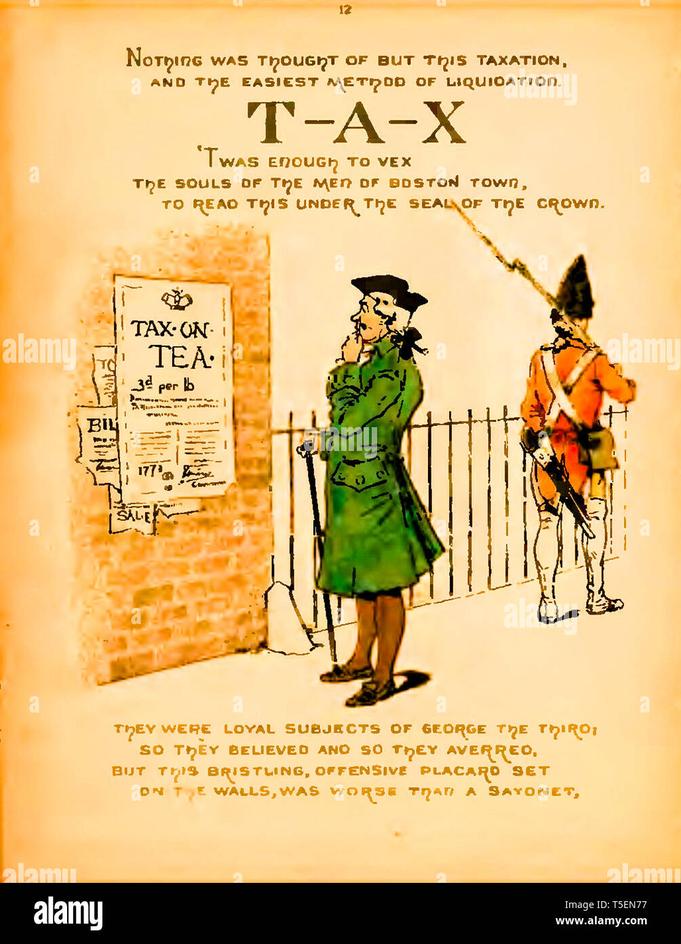

Townshend Acts and the Remaining Tea Tax

Before 1773, the Townshend Acts of 1767 had imposed a 3 pence tax per pound on tea along with other goods. By 1770, the British government lifted tariffs on those other items but kept the tea tax alive. The colonists saw this as an ongoing grievance. The tax wasn’t huge—just 3d per pound—but it symbolized Britain’s right to tax the colonies without their say.

How Smugglers and Merchants Stirred the Pot

This tax and the EIC’s new ability to sell tea cheaply through chosen merchants disrupted smugglers’ businesses. Folks like John Hancock and Sam Adams, well-known colonial figures, were heavily involved in smuggling Dutch tea—a cheaper alternative. Legend has it, “Sam Adams writes the letters, and John Hancock pays the postage.”

The EIC’s move undercut smugglers by eliminating middlemen and giving their tea a price advantage all while still collecting a tax from the colonists. Imagine running a business only to have a massive competitor swoop in with government backing and sell products cheaper. That’s exactly what happened to Hancock and his pals.

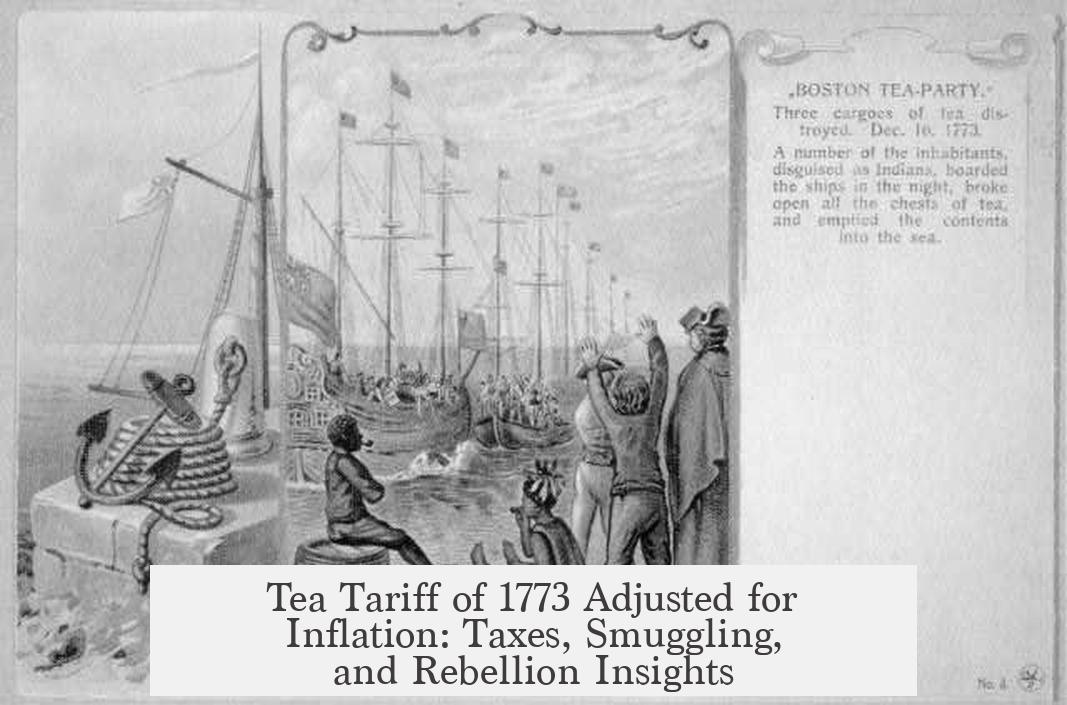

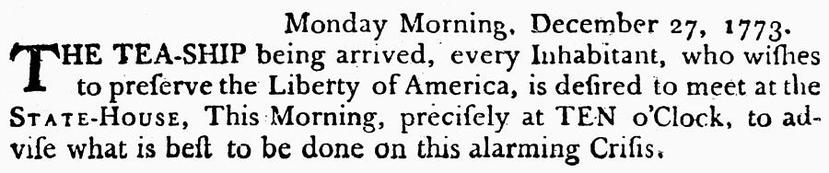

The Boston Tea Party and the Cost of Defiance

When the tea shipment arrived in Boston harbor, the colonists refused to unload it, eventually tossing 342 crates (about 90,000 pounds) of tea overboard. This spectacular act of defiance became known as the Boston Tea Party.

Let’s talk numbers:

- The East India Company claimed damages worth £9,569.

- Experts estimate that’s roughly $1.7 million today when adjusted for inflation.

- The tea weighed about 90,000 pounds, translating to a price of approximately 0.11£ per pound (roughly 2 shillings).

So each pound of tea was pretty pricey back then—about 4 shillings retail. The 3d wholesale tax added about 20-25% to the cost, not insignificant for everyday colonists.

More than Just a Tax: The Bigger Picture

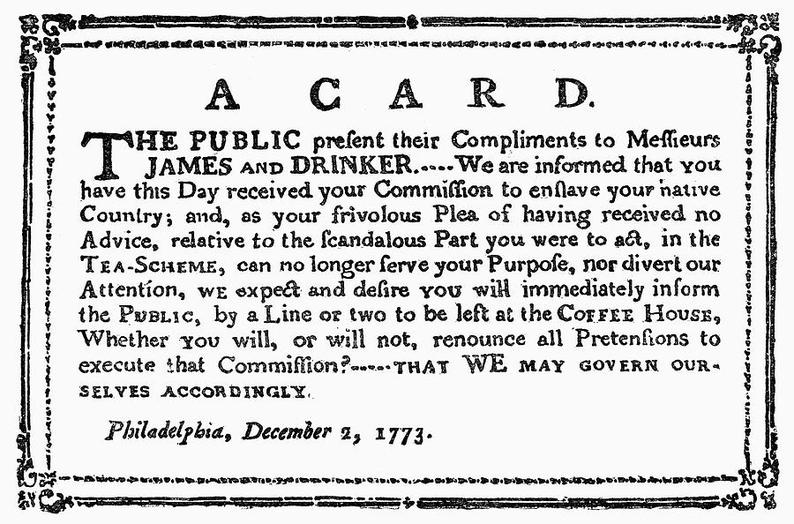

Here’s where history gets spicy. The colonists didn’t rage over the small tax alone. The issue ran deeper, clawing at the heart of representation and market fairness. The Tea Act wasn’t just about taxes—it’s about who got to decide them.

The market manipulation by the British government favored the EIC and hurt local merchants, including smugglers who were also community leaders. Plus, the colonists had no elected representatives in Parliament. They viewed the tax as an overreach of authority—taxation without representation.

Could lowering the tea’s cost have stopped the rebellion? Probably not. The colonists wanted a say in their own governance, and the tea tariff was a tipping point, not the whole mountain.

What Can We Learn from Tea Tariff Adjusted for Inflation?

Adjusted for today’s money, the £9,569 damage claim equates to over $1.7 million. That’s hefty—for tea no less! Understanding the inflation-adjusted costs helps us appreciate just how serious the economic stakes were. It wasn’t just about tea—it was about power, control, and fairness.

Imagine a company today getting a government exemption that lets it undercut local businesses, while the public has zero say in the matter. Frustration is bound to bubble over.

Final Sip: What if History Repeats Itself?

This episode isn’t just an old story for history buffs; it’s a lesson in economics, governance, and consumer impact. Smuggling to beat tariffs, market manipulation, and lack of voice? Those rings still echo today in debates around taxes, trade policy, and representation.

Next time you sip your tea, ask: how much am I really paying, and who set that price? As the events of 1773 remind us, a seemingly simple tariff can become a catalyst for profound change.

What was the actual tariff imposed on tea in 1773?

The tax was 3 pence per pound of tea, set by the Townshend Acts of 1767. Other tariffs were removed in 1770, but the tea tax stayed. This tax raised the wholesale price by about 20-25%.

Did the Tea Act of 1773 create a new tax on tea?

No, it did not introduce a new tariff. Instead, it lowered costs for the East India Company by letting them export tea duty-free to the colonies, undercutting smugglers and local merchants.

How much would the tea tax from 1773 be worth today after inflation?

The direct damage from the Boston Tea Party was £9,569. Experts estimate that in today’s money, this would equal roughly 1.7 million dollars, reflecting the large scale of the tax’s impact.

Why was the Tea Act so controversial despite a reduced tariff?

The issue was less about the tax amount and more about market control and taxation without colonial representation. The East India Company could pick select merchants, undermining local traders and colonists.

How was the tea valued per pound around 1773?

Each pound of tea cost about 4 shillings at retail. The 3d tax added significantly to the wholesale price, affecting consumers and merchants alike in the American colonies.