The Rockefeller fortune has significantly diminished in raw size due to division among heirs and taxes but remains substantial through savvy investments and sustained wealth management.

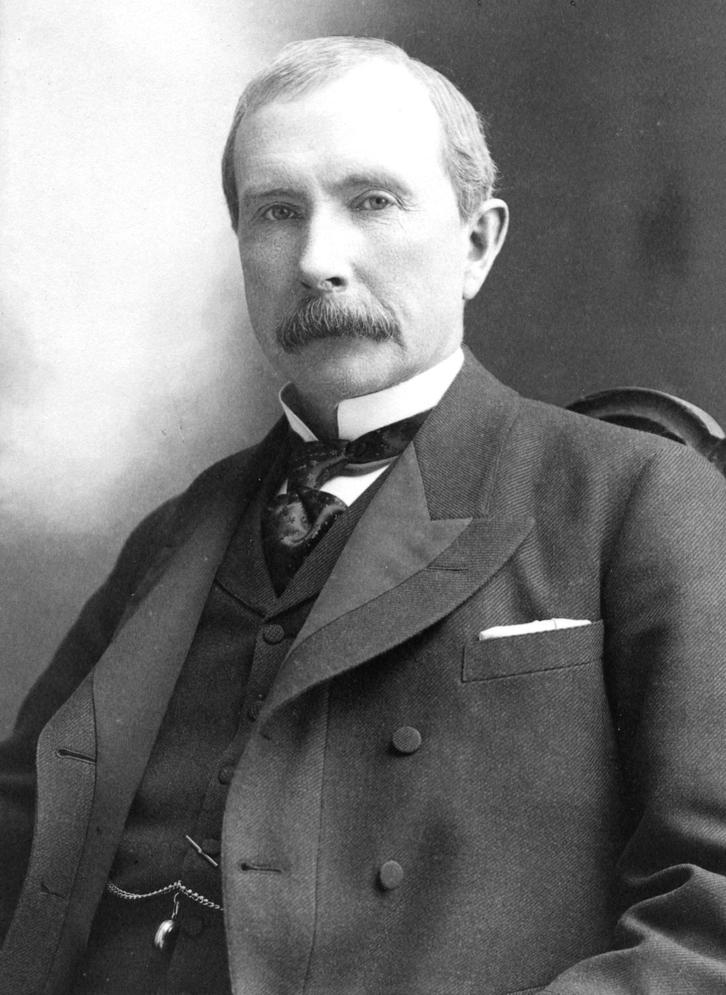

The original Rockefeller wealth was immense during the Gilded Age. John D. Rockefeller was once worth the equivalent of $336 billion in the money of his time. However, translating that wealth to today’s value is complex because of inflation and the time value of money, which means money now is worth more than the same amount later.

Estate and death taxes have reduced the fortune substantially. These taxes take a notable portion when the wealth passes from one generation to the next. Additionally, the fortune is divided now among approximately 200 family members. This spread across so many heirs, each managing their own household and expenses, naturally dilutes individual shares.

Despite these challenges, the Rockefellers still hold considerable assets. They made smart investments over the decades. Ownership of Chase Manhattan Bank and early stakes in companies like Apple helped maintain and grow parts of their wealth. Their situation differs from the Gilded Age, where fortunes like Rockefeller’s were more concentrated and dominant.

Therefore, while today’s Rockefeller fortune does not compare to the extreme concentration of wealth in the late 19th and early 20th centuries, sustaining wealth over many generations is rare and notable. The family continues to be classified among the wealthy due to prudent financial decisions and diversified assets.

| Factors Affecting Rockefeller Fortune | Details |

|---|---|

| Estate and Death Taxes | Reduced fortune when passed down |

| Division Among Heirs | Split among ~200 family members |

| Time Value of Money | Original valuation higher in past dollars |

| Smart Investments | Chase Manhattan Bank, Apple |

| Wealth Sustainability | Wealth remains but less concentrated |

- The fortune has been significantly divided among many heirs.

- Estate taxes have considerably lowered the original value.

- Original valuations were massive but not directly comparable to today’s dollars.

- Smart investments have preserved substantial wealth.

- The family remains wealthy but not in the Gilded Age’s scale of concentration.

What Happened to the Rockefellers Fortune?

The Rockefellers’ fortune has changed a lot since its heyday in the Gilded Age. It didn’t just stay frozen in time or magically grow forever. Instead, estate taxes, multi-generation divisions, and the way money works over time all played roles in reshaping that legendary wealth. Let’s unpack what really happened to one of America’s most famous fortunes.

First, it’s important to remember how massive the Rockefeller wealth was back in the late 19th and early 20th centuries. At its peak, the Rockefeller brothers—John D. Rockefeller Sr. and his siblings—were valued at a combined $336 billion in today’s terms. That’s a staggering number, but here’s the catch: that valuation was huge for its time, not an eternal glass ceiling.

Many people assume that wealth like this just multiplies infinitely. You’ve probably thought, “Surely the Rockefellers must be trillionaires by now!” But money doesn’t behave like a magic bean—it follows economic rules and real-world constraints.

Why You Shouldn’t Expect That Money to Just Grow

One key factor people often overlook is the time value of money. This principle says money today is worth more than the same amount in the future. Inflation, opportunity, and spending power all chip away at what those billions mean decades later. So, even if the fortune stayed “the same” in number, it effectively shrinks in real value over time.

Plus, the fortune wasn’t left to one person or a handful of heirs. Upon the deaths of John D. Rockefeller Sr. and his brothers, the fortune was divided among roughly 200 family members. Imagine dividing a giant cake that many ways—and then everyone has their own lifestyle expenses. Naturally, this dilutes individual wealth across generations.

Taxes: The Unseen Wealth Thief

Estate and death taxes also played a significant role. When your net worth jumps from generation to generation, tax laws demand their share. These estate taxes can slice off substantial portions of inherited riches. So each time the money passes hands, Uncle Sam takes a cut.

This combination of division and taxation ensured that the colossal wealth of one era wasn’t just handed down intact.

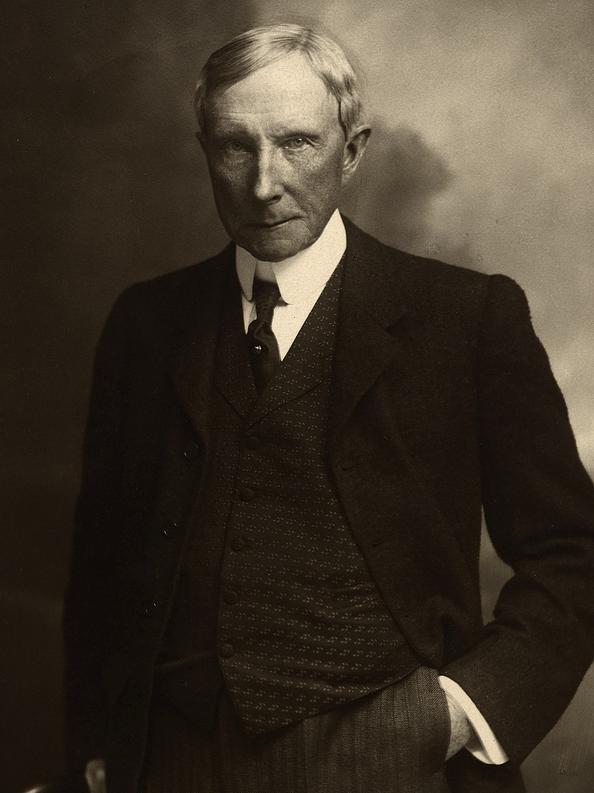

But The Rockefellers Didn’t Just Fade Away

Despite this (what sounds like) financial slow bleed, the Rockefeller family remains wealthy even today. This is a testament to smart investing and prudent management. They wisely expanded their holdings beyond oil. For example, they owned Chase Manhattan Bank for decades—a powerhouse in finance.

Additionally, they were early, large investors in Apple, which is a pretty savvy move if you ask me. This diversified approach kept the family’s financial engine running, even if it’s not the eye-popping sum of the Gilded Age.

Why Wealth Survives Even When It Shrinks

Many wealthy families struggle to keep fortunes intact over generations. The Rockefellers are examples of success stories in that regard. Maintaining wealth requires careful planning, reinvestment, and adaptability—not just a big starting pot of gold.

Think of wealth like a garden. You can’t simply plant seeds and expect endless fruit forever. You need to tend to it, protect it from pests (hello, taxes), and replenish the soil against time’s wear. The Rockefellers did just that with their investments.

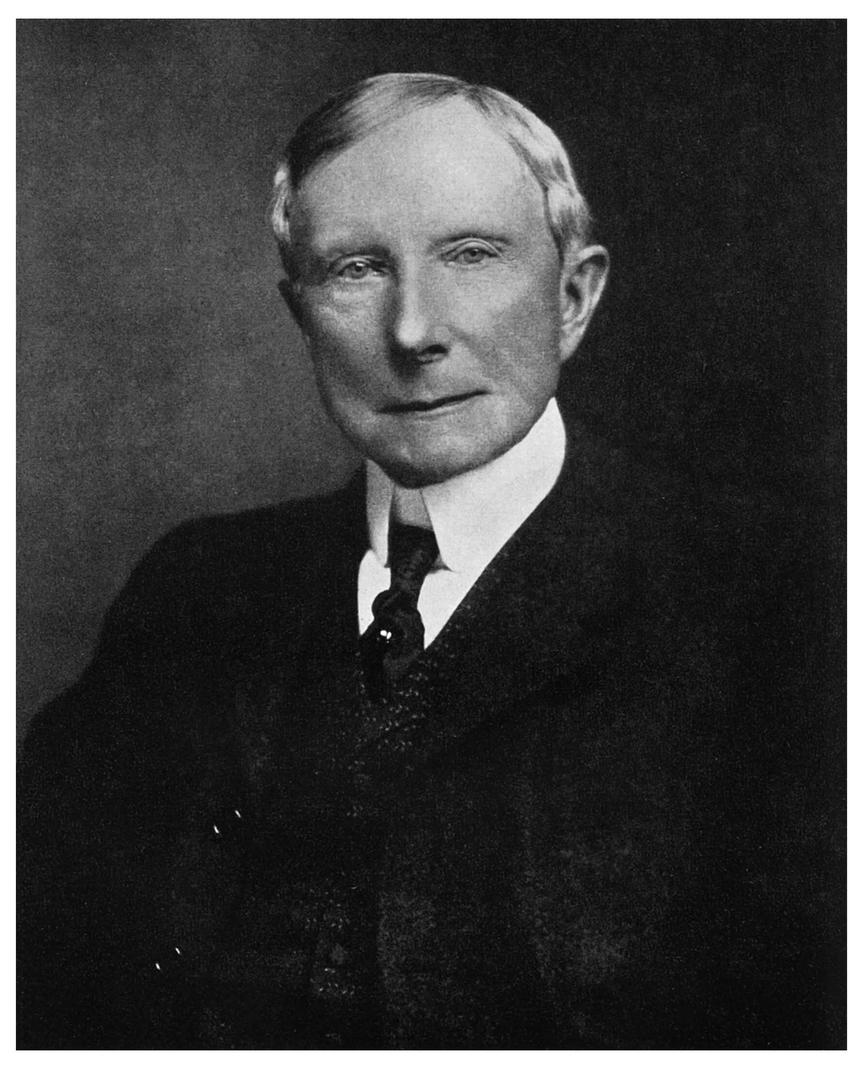

The Gilded Age Comparison

Back in the days of Rockefeller, Carnegie, and JP Morgan, wealth was hyper-concentrated. The industrial barons controlled empires that dwarfed many economies. Society then was more accepting—or at least more resigned—to enormous wealth disparities.

Today, the Rockefellers’ fortune looks smaller not because the family failed but because the economy, laws, and society have evolved. Wealth is more dispersed, and inflation shifts the meaning of “billion” over a century.

What This Means for Curiosity about Rich Families

When you hear “Rockefeller fortune,” think legacy, not just money. Their influence extends beyond dollars—philanthropy, art patronage, and shaping banking and business practices all carry their mark.

So next time someone says, “What happened to the Rockefellers fortune?” you’ll know the answer is layered. They lost a bit here, divided their wealth there, paid taxes along the way, but kept their core advantage through smart moves. Their fortune didn’t vanish—it transformed, adapted, and lives on.

Takeaways for Wealth and Legacy Management

- Don’t assume massive wealth grows infinitely without effort.

- Estate taxes and division dilute fortunes over time.

- Time value of money changes the worth of fortunes dramatically.

- Smart diversification (like owning banks or tech stocks) sustains wealth.

- Legacy means more than just dollars; influence and impact matter too.

Is it possible to build a fortune that lasts centuries in one family? It’s rare but not impossible. The Rockefellers aren’t a cautionary tale, but an example of preservation in a dynamic financial world.

In the end, their story invites us to think: How do you keep treasures alive for future generations without losing what made them special? That’s a question worth pondering whether you’re managing millions or just your personal legacy.

What caused the Rockefeller fortune to decrease over time?

Estate and death taxes took a significant portion of the wealth. Additional reductions happened as the fortune was divided among many descendants.

How has the Rockefeller fortune been divided among family members?

Since the deaths of the original Rockefellers, the fortune has been split between around 200 family members. Each has their own expenses, reducing individual shares.

Why is the Rockefeller wealth not as large today as it was historically assumed?

The original fortune was valued in historical terms, not adjusting for inflation or the time value of money. Over time, money loses value, so the nominal figure back then doesn’t equal today’s worth.

Did the Rockefeller family manage to maintain some wealth across generations?

Yes. They made smart investments like owning Chase Manhattan and investing in Apple. These moves helped sustain wealth, even if it isn’t at Gilded Age levels.

Is the Rockefeller fortune comparable to other Gilded Age fortunes today?

No. Wealth concentration during the Gilded Age was extreme, as with Rockefeller, JP Morgan, and Carnegie. Modern wealth distribution is more spread out, and old fortunes have shrunk in relative terms.