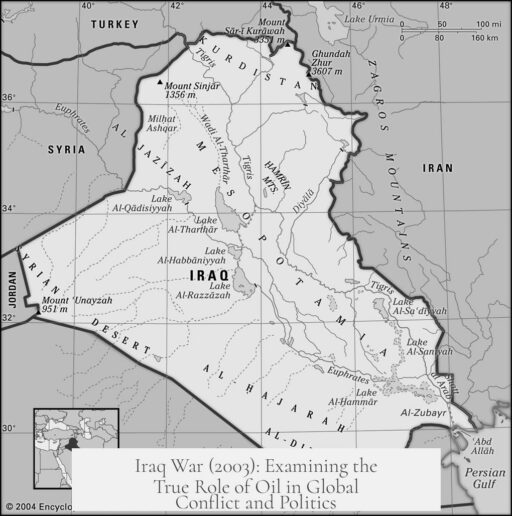

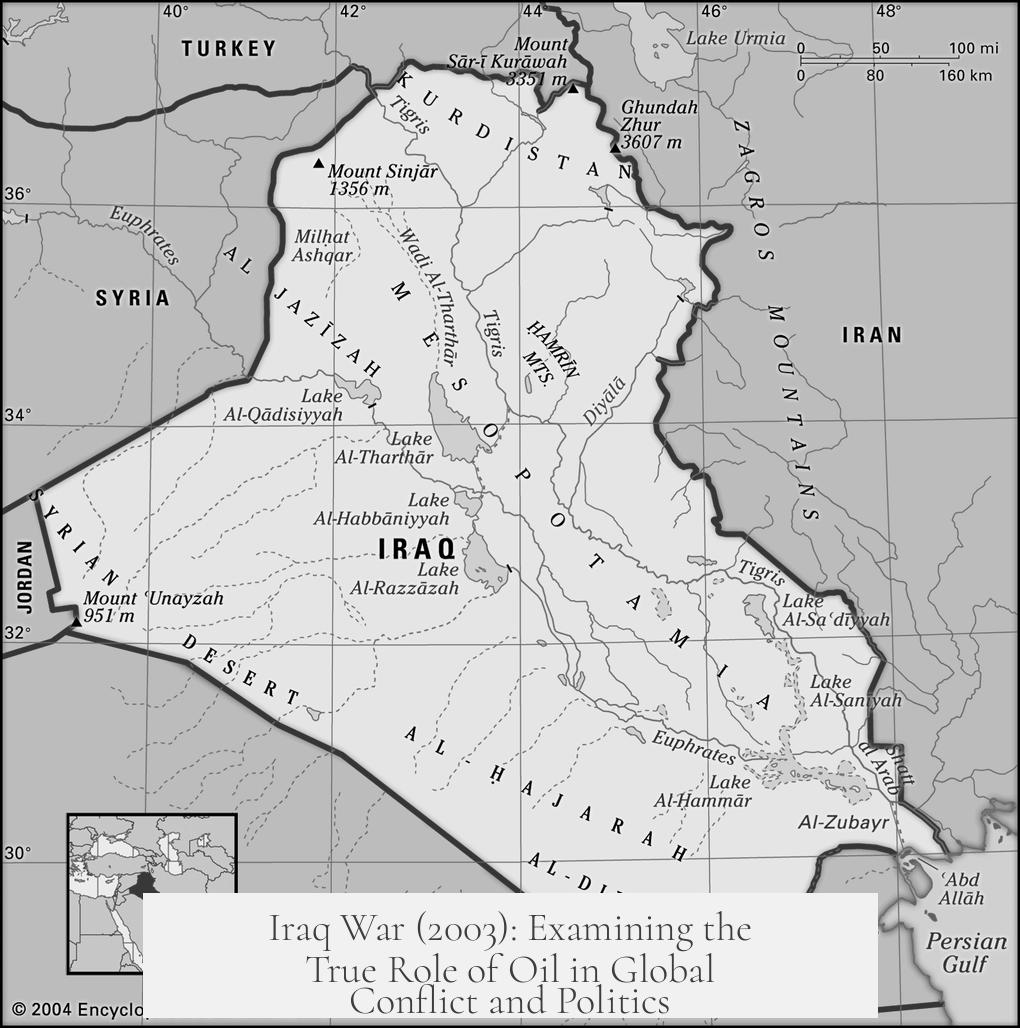

The Iraq War of 2003 was strategically related to oil, but it was not primarily about the United States making direct profits or gaining control over Iraqi oil assets. Iraq holds the world’s fifth-largest proven oil reserves, estimated at 145 billion barrels, which is about 8.5% of global reserves, surpassing those of Russia. This vast resource makes Iraq a significant player in global energy markets and a strategic interest for any major power. The U.S. concern with Iraq partially stems from this reality.

Oil’s strategic importance to U.S. foreign policy explains why the Middle East, including Iraq, remains a focus of American interest. However, the objective of the 2003 war did not center on acquiring the oil fields or profiting directly from Iraqi oil production. After the invasion, the Iraqi government retained control over its oil resources through the Iraqi Oil Ministry. Efforts to privatize the sector did occur but did not transfer ownership to U.S. companies. Instead, the larger share of Iraqi oil exports go to Asian and European buyers, not American ones.

While some U.S. companies won service contracts with Iraq after the war—contracts to assist with oil infrastructure or operations—these contracts were shared with international partners, including French and Chinese firms. China’s state companies, linked to deals originally made under Saddam Hussein, continue operating in Iraq’s oil sector. This arrangement demonstrates the multinational nature of Iraqi oil post-conflict rather than exclusive U.S. control or profit.

The roots of Iraq’s oil industry trace back to the early 20th century. Oil was first discovered in 1908 when Iraq was part of the Ottoman Empire. The Turkish Petroleum Corporation (TPC) was created with stakes shared among Anglo-Persian Oil, Deutsche Bank, and Shell. After World War I, the British took control of Iraq under a mandate, expelling German interests and adjusting shares to include French companies. The United States was initially excluded but gained access through the 1928 Red Line Agreement. Discoveries in Kirkuk in 1927 propelled the Iraqi Petroleum Corporation (renamed from TPC) into a major oil concession holder.

Nationalization became a turning point in Iraq’s oil history. Iraq helped found OPEC in 1960 and nationalized its oil industry by 1961. This move ended much direct Western private control. British and American companies were expelled after the 1967 Six Day War as Iraq replaced their operations with Soviet technical and financial support. Saddam Hussein, in a key role at the time, consolidated national control, including nationalizing French interests by 1972. The Soviet Union’s involvement helped Iraq maintain production and sales despite Western efforts to isolate it.

The Iran-Iraq war, followed by the 1991 Persian Gulf War, inflicted damage on Iraq’s oil infrastructure. Subsequent sanctions limited Iraq’s ability to sell oil freely, restricting exports to the Oil for Food program starting in 1995. Production fell from previous highs to 2.5 million barrels per day by 2000, dropping further after the 2003 U.S. invasion. Post-invasion recovery of oil production was slow. It was only after the U.S. military withdrawal in 2011 that production surpassed the pre-invasion levels, reaching levels comparable to the late 1970s.

In summary, oil was a strategic consideration in the Iraq War. The U.S. valued Iraqi oil as part of its broader geopolitical interests in the Middle East. However, the war was not a campaign to seize oil fields or secure direct economic control over Iraqi petroleum. The Iraqi government retained authority over its oil industry. Production and exports did not shift primarily toward the U.S., but instead maintained diverse international partnerships. The historical legacy of oil in Iraq shows a complex balance of international influence, nationalization, and geopolitical contest.

- Iraq holds the world’s fifth-largest proven oil reserves, making it strategically important.

- The U.S. did not gain direct control or profit substantially from Iraqi oil after the 2003 invasion.

- Iraq’s oil industry remained under Iraqi government control post-invasion.

- International companies from France, China, and other countries maintained a significant role in Iraq’s oil sector.

- Oil production declined due to wars and sanctions but has slowly recovered only after U.S. withdrawal.

- Oil was a strategic factor in U.S. Middle East policy, but not the sole or material reason for the Iraq War.

Was the Iraq War (2003) really about Oil?

Let’s get straight to it: Yes, oil was a strategic factor in why the US cared so deeply about Iraq, but no, the war wasn’t launched so America could directly cash in on Iraqi oil profits. That might sound like a disappointing plot twist for conspiracy theorists, but the reality is more complex and, frankly, a bit more boring if all you want is “black gold treasure hunting.”

Now, untangle yourself from Hollywood’s version of oil wars and dive into the real story behind Iraq’s oil and its geopolitical chess moves.

The Giant Under the Ground: Iraq’s Oil Reserves and Why They Matter

Iraq isn’t just any oil producer—it holds the fifth largest proven oil reserves worldwide, with about 145 billion barrels, roughly 8.5% of the global total. It’s sitting ahead of Russia—yes, that Russia. This is no small fry situation. In an energy-hungry world, that stake draws major global powers’ attention, including the US.

Think of it like a kid with a giant cookie jar—everyone wants a piece, but not everyone is allowed to reach in.

Strategic Importance Vs. Material Gain

Oil is a strategic asset for the US. It’s a critical reason why America traditionally keeps an eye—and sometimes a boot—in the Middle East. Controlling or influencing this region helps the US shape global energy markets and maintain power balances.

But here’s the kicker: after the 2003 invasion, the US did not gain direct ownership of Iraqi oil fields or an exclusive pipeline to the American gas tanks. The Iraqi Oil Ministry retained formal control despite some privatization chatter during the occupation. So, no direct profit bonanza for Uncle Sam.

How do we know? Most of Iraq’s oil pours out to Asian markets like India and China, plus a fair share goes to Europe. The US isn’t the end customer. Instead, Iraqi oil is a globally traded commodity.

A Global Tug-of-War: Who Controls What?

Some US companies scored lucrative service contracts under the 2007 Iraqi energy law, but it wasn’t a US-only party. French companies and even a Chinese state oil firm—ironically brought in during Saddam’s era—are players in today’s oil business in Iraq. It’s an international marketplace, not a US oil monopoly.

History Repeats (Or At Least Provides Context)

To truly understand the link between Iraq and oil, rewind to the early 1900s. Oil was first found in Iraq in 1908, when it was Ottoman land. Back then, the Turkish Petroleum Corporation (TPC) formed. This consortium included the Anglo-Persian Oil Company (now BP), Germany’s Deutsche Bank, and Shell.

After World War I reshuffled borders and mandates, Britain grabbed control of Iraq, taking the German shares from TPC and offering some to France instead. The US, feeling a bit left out, protested. By 1928, the “Red Line Agreement” gave several US oil giants a share, acknowledging their spot at the table.

Kirkuk oil fields were discovered in 1927, and a few years later the TPC rebranded as the Iraqi Petroleum Corporation, operating under a concession from the Iraqi government.

Nationalization and Cold War Oil Politics

Iraq became a founding member of OPEC in 1960, then nationalized its oil industry in 1961. That scared Western powers, but Iraq leaned on the Soviets for technical support and trade after pushing out US and British companies during the volatile 1960s and 70s.

By 1972, Soviet support helped Iraq weather the storm of international pressure and embargoes led by the US and UK. Iraq wasn’t going to be anyone’s oil puppet.

Modern Era: Sanctions, Wars, and Oil Production

Fast forward to the late 20th century—the Iran-Iraq War damaged oil infrastructure. The 1991 Gulf War hit Iraq’s production hard. Then came sanctions limiting Iraq’s capacity to export, forcing reliance on the Oil-for-Food Program starting in 1995. Production sank from about 2.5 million barrels per day in 2000 to 1.5 million after the 2003 invasion.

It’s like trying to run a race with a sprained ankle.

What Happened After America Left?

Post-2011, after US troops withdrew, Iraqi oil production climbed back to pre-2003 war levels, hitting late 1970’s figures. That’s a slow comeback, with current production having plateaued. The infrastructure and stability needed to boost production is still a work in progress amidst political and security challenges.

So, despite the invasion shaking things up, the oil wells didn’t suddenly gush profits into US accounts.

So, Was It Really About Oil?

Oil was definitely a strategic reason for the US to keep tabs on Iraq but wasn’t the direct material reason for the invasion. The US didn’t aim to steal, control, or directly profit off Iraqi oil via ownership or exports. The picture is one of geopolitical maneuvers: the US seeks influence over a critical global energy region, not ownership of its resources.

Ask yourself: When a landlord bails on the property, does the neighbor start collecting the rent, or just watch who rents the place next? The US was more like the neighbor watching from the fence, influencing terms but not collecting rent checks directly.

What Does This Mean for Understanding Global Politics?

It’s a reminder that global resource control does not always translate to direct ownership or profit. Influence, strategic positioning, and maintaining stability in energy-producing regions often matter more to great powers.

The Iraq War’s motivation reflects complex factors, including weapons of mass destruction concerns, regional security, and yes, strategic energy interests. But oil profits? Not so simple or direct.

Takeaway for Readers: Why This Matters Today

Understanding the Iraq War through the lens of oil leads to better insights into international relations and energy security. It’s not just about grabbing resources but securing global supply chains and geopolitical balance.

If you’re following today’s world events—such as shifting alliances in the Middle East or the increasing demand for energy in Asia—you’ll see echoes of this complex dance.

So, next time someone says the Iraq War was “just about oil,” you’ll be equipped to say: yes, oil was a big reason for the US to care, but the story’s far richer and messier than that.