The 7th Amendment guarantees the right to a jury trial in civil cases where the value exceeds $20, a figure set in the 18th century. The framers of this rule likely understood inflation but did not foresee its modern steady rise. They used this amount more symbolically than as a literal value meant to hold unchanged.

The 7th Amendment’s jury trial guarantee applies to civil cases “at common law” where the amount in controversy exceeds $20. This threshold was established at the time of the amendment’s adoption in 1791. Back then, $20 represented significant value—approximately equivalent to $300 today. Records offer little explicit insight into why exactly $20 was chosen. It appears the decision occurred during a closed-door congressional session, leaving the framers’ precise intent uncertain.

Scholars agree the framers knew inflation was possible but thought it would be irregular, not the persistent upward trend familiar now. Economically, the late 18th and early 19th centuries experienced considerable price fluctuations, including both inflation and deflation. Sustained inflation as a policy concern only emerged in the 20th century, well after the Bill of Rights.

Some legal experts, like Columbia Law’s Philip Hamburger, suggest the founders deliberately set the $20 threshold low, anticipating its gradual erosion by inflation. This interpretation argues that over time, fewer cases would exceed that amount, shrinking jury trial requirements. This theory, while intriguing, requires assumptions with little direct historical evidence. It conflicts with the general view that the $20 clause served more as a baseline to guarantee jury trials in meaningful cases.

The practical impact of the $20 rule is limited. Federal courts rarely see civil cases involving claims under even the historical equivalent of $300. Furthermore, federal jurisdiction plays a key role. Diversity jurisdiction requires an “amount in controversy” exceeding $75,000. Thus, cases qualifying for diversity jurisdiction would never be below a $20 threshold. Federal question cases can involve smaller sums but typically concern broader legal issues rather than minor monetary disputes.

| Jurisdiction Type | Amount Requirement | Effect on $20 Threshold |

|---|---|---|

| Diversity Jurisdiction | Over $75,000 | $20 minimum irrelevant here |

| Federal Question Jurisdiction | Any amount | $20 may technically apply, but low-value cases rare |

The jury trial right covers “common law” cases, excluding equity matters, admiralty, and suits against states. Parties may also waive the right to a jury. These limitations, alongside the amount threshold, narrow practical application beyond initial appearances.

Regarding monetary policy, in 1791, no formal mechanism existed to manage inflation. The United States endured volatile economic periods during the 1800s, with average inflation rates actually negative due to frequent deflation and financial crises. A central bank formed only in 1913, and coherent monetary policy emerged chiefly in the 20th century starting around the 1930s. Understanding and controlling inflation became a gradual process over the next century.

Thus, the framers included a monetary threshold without embedding inflation adjustments. They lacked the tools to foresee inflation’s long-term creep or how it would undermine fixed nominal amounts over centuries.

Given all factors, the $20 figure is best seen as a historical marker. It confirms the right to jury trials for civil claims exceeding minimal value, while in practice serving a largely symbolic role in modern federal courts. The evolution of jurisdiction limits and economic understanding has rendered the $20 threshold mostly moot.

- The 7th Amendment’s $20 jury trial value reflects an 18th-century standard, roughly $300 today, not adjusted for inflation.

- The framers knew inflation could occur but did not anticipate steady modern inflation and lacked monetary policy tools.

- Some scholars propose the $20 was chosen to naturally phase down jury trials as inflation eroded its value, though this remains speculative.

- Federal jurisdiction rules, especially the $75,000 diversity jurisdiction threshold, typically override the $20 minimum.

- Jury rights apply only to “common law” civil cases, excluding many case types and accept waivers.

- Economic history shows unstable prices and deflation for 100 years post-1791, making the $20 figure reasonable at the time.

- Today, the $20 clause remains mostly symbolic and does not practically limit jury trial rights in federal court.

Did the Founders Forget Inflation When Setting the 7th Amendment’s $20 Jury Trial Threshold?

The 7th Amendment to the US Constitution guarantees the right to a jury trial in civil cases where the value exceeds $20. Did the framers of the Constitution overlook inflation when placing this seemingly tiny monetary benchmark? Let’s unpack this intriguing historical and legal dilemma that often causes modern readers to raise their eyebrows.

The 7th Amendment states: “In suits at common law, where the value in controversy shall exceed twenty dollars, the right of trial by jury shall be preserved.” Back in the late 18th century, $20 was not chump change; it was about equivalent to $300 today. So, did the authors really ignore inflation, or was there a deeper strategy?

Understanding the 7th Amendment’s $20 Clause

First, it’s important to realize the “right to a jury trial” guaranteed by the 7th Amendment isn’t a blanket rule for every single civil case. It applies mainly to civil cases “at common law,” a somewhat technical term referring to cases based on legal precedents, excluding certain types like equitable suits.

Interestingly enough, the $20 figure was inserted during a closed-door session of Congress, leaving historians with very little direct commentary on the reasoning behind the amount. However, it is clear the framers were aware of inflation as a concept, though they couldn’t have predicted its steady climb in modern times.

Did the Founders Truly Not Know About Inflation?

One might assume the framers ignorantly set a static dollar threshold doomed to become meaningless. However, the truth is more nuanced. The framers lived through economic turbulence — the late 1700s and early 1800s involved wars, bank panics, and fluctuating currency values.

They understood that money could lose or gain value, but sustained inflation as we experience today was not part of their economic landscape. In fact, historical data show that throughout the 19th century, inflation was often negative, meaning prices generally went down due to deflationary pressures.

This ebb and flow meant the concept of stable positive inflation seemed almost theoretical rather than practical. Since monetary policy barely existed, the framers lacked frameworks to predict or legislate around future inflation properly.

Scholarly Theories: Was the $20 Amount Purposefully Low?

Some scholars, like Columbia law professor Philip Hamburger, have suggested an intriguing theory: the founders might have set the $20 bar quite low on purpose, foreseeing that inflation would erode its value, thus gradually tightening the jury trial requirement over time.

“The $20 clause was intended to become less valuable due to inflation, ensuring stricter jury requirements as time passed.”

— Interpretation by Philip Hamburger

This theory positions inflation as a subtle legislative tool—sort of like a grandfathered automatic adjustment that the framers embedded without the need for constant amendments. Still, this interpretation involves reading between the lines and requires assumptions that lack explicit supporting documentation.

And despite the fascinating speculation, not everyone is convinced. After all, it’s a big leap to claim the founders had a secret inflation-adjustment mechanism when modern monetary policy and inflation theories were not yet established.

Practical Realities: The $20 Threshold’s Meaning Then and Now

Does the $20 threshold actually affect courts today? Generally, no. Cases worth less than $20 seldom reach federal courts. Even when adjusted for inflation, that $20 back then was roughly $300 today—a tiny sum for most serious civil disputes.

Moreover, federal courts have jurisdictional rules requiring much higher amounts in controversy, especially under diversity jurisdiction (at least $75,000 today). This means cases involving parties from different states need to exceed $75,000 to qualify for federal courts, effectively sidelining the $20 figure.

For cases arising directly under federal law (“federal question jurisdiction”), theoretically, civil cases can involve any amount. But no sane plaintiff would drag their case to court over a couple of hundred bucks when the litigation costs and effort would far outweigh the reward.

Thus, the $20 threshold is mostly symbolic, emphasizing that trivial claims aren’t jury trial material, while more substantial disputes merit this constitutional right. In this light, the figure serves as a historical litmus test, not an active financial boundary.

Limitations and Waivers: Jury Trials Aren’t Always the Default

It’s not just about the dollar amount; the right to a jury applies only to common law cases. Courts exclude many case types, such as those involving equitable remedies, admiralty, or sovereign immunity.

Moreover, parties can waive their jury trial rights. Think of it as agreeing to settle disputes with a judge alone, often to save time and legal costs. So even if the case exceeds $20, a jury trial doesn’t automatically happen.

Why Inflation Was an Uncrackable Puzzle for the Founders

Let’s be honest: the founders were pioneers in a realm where economics was barely understood. There was no Federal Reserve, no concept of systematic monetary policy, and the science of macroeconomics didn’t exist.

Monetary policy as a tool only emerged in the early 20th century. The Federal Reserve System was created in 1913. Before that, inflation was unpredictable, sometimes wildly swinging up or down. In fact, some decades in the 1800s saw double-digit deflation, wiping out the notion of steady inflation.

During the 1930s, the import of inflation control started gaining traction, culminating in the more sophisticated monetary policies of the late 20th century. So, the framers were writing on a blank slate without inflation adjustment blueprints or modern economic theory.

Final Thoughts: Should We Care About the $20 Figure Today?

This age-old constitutional clause is a bit like a vintage car: fascinating to study, still functional, but not always practical in a modern context. The $20 figure doesn’t derail jury trials today because the federal court system’s jurisdiction practically requires much higher thresholds.

Some may argue the amendment should be updated or its meaning clarified, but courts and lawmakers have generally adapted through statutory law, judicial interpretation, and procedural rules rather than rewriting the Constitution.

So, did the authors not know about inflation? They knew it existed but couldn’t predict the rollercoaster ride ahead. Their $20 benchmark wasn’t a naïve oversight. Instead, it was set in a vastly different economic environment with different priorities. Some believe they cleverly left room for the clause to evolve through inflation’s natural force. Others see it as a symbolic nod to ensuring bona fide civil claims get a jury trial.

Have you ever thought about how a $20 rule from 1791 could shape legal procedures centuries later?

This tiny clause reminds us how constitutional text locks in ideas frozen in time, challenging modern interpreters to balance historical context, real-world economics, and evolving legal standards. It’s a curious blend of law, economics, and history that shapes how justice is administered even today.

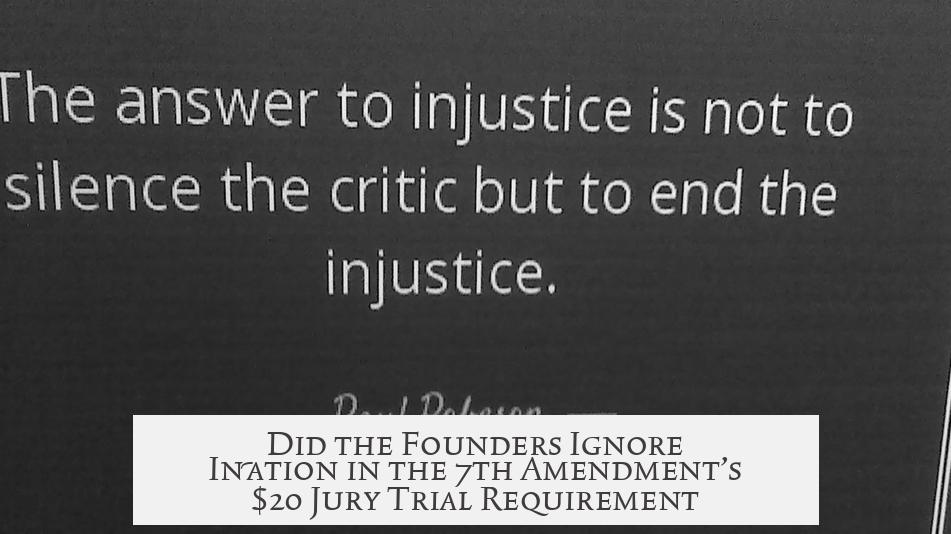

Summary Table: From $20 in 1791 To Modern Court Cases

| Aspect | 1791 Context | Modern Context |

|---|---|---|

| Value of $20 | Equivalent to approx. $300 today | Largely symbolic; overshadowed by $75,000 jurisdiction threshold |

| Inflation Awareness | Known but unpredictable; no monetary policy | Fully recognized, regulated by Federal Reserve |

| Jury Trial Right Scope | Applies to “common law” cases over $20 | Still applies, but parties can waive rights; excludes equity, admiralty |

| Legal Interpretation | Possible intentional low threshold | Mostly symbolic; practical influence limited |

For legal buffs, history geeks, and anyone curious about how old rules echo today, the $20 jury trial clause offers a fascinating glimpse at the Constitution’s enduring dance with economics, justice, and time.